Table of Contents

Introduction

Money is an essential part of life, and financial stability is something everyone strives for. However, financial challenges can often lead to stress and anxiety, which can, in turn, affect your overall health and happiness How to Manage Financial Anxiety. If you frequently worry about bills, savings, or your financial future, you may be experiencing financial anxiety—a condition that is increasingly common in today’s fast-paced economic environment. Learning how to manage financial anxiety is crucial, as it empowers you to regain control over your emotions, make informed financial decisions, and ultimately improve your overall well-being.

In this blog, we will delve into effective strategies for managing financial anxiety by outlining seven actionable steps that can help reduce stress related to money. By implementing these strategies How to Manage Financial Anxiety, you can develop a healthier relationship with money, cultivate a sense of security, and live a more balanced and fulfilling life. Financial well-being is not just about accumulating wealth; it’s about developing a mindset that embraces financial literacy and resilience, allowing you to navigate both expected and unexpected challenges with confidence.

1. Identify the Root Cause of Your Financial Anxiety

The first step in understanding how to manage financial anxiety is identifying its root cause. Financial stress can arise from various factors such as:

- Debt: Owing money can be overwhelming, especially when high-interest rates keep adding to the burden. The cycle of minimum payments can feel never-ending, creating a tangible weight on your shoulders How to Manage Financial Anxiety. The emotional toll of debt can spill over into personal relationships, affecting your overall quality of life.

- Low Income: Struggling to make ends meet can create a perpetual state of worry and anxiety about the future, leading to a feeling of helplessness that can often permeate other aspects of life. The stress of financial instability can limit your ability to pursue opportunities or enjoy leisure activities.

- Lack of Savings: Without an emergency fund, unexpected expenses can trigger significant stress and panic, leaving you feeling vulnerable and unprepared for life’s unpredictability. This lack of financial cushion can hinder your capacity to take risks or make investments in your future.

- Poor Financial Management: Lack of budgeting or impulsive spending can lead to a cycle of financial chaos. Every impulsive purchase can contribute to feelings of regret and further anxiety. The inability to track spending can foster a sense of disempowerment, making it harder to envision a path toward financial freedom.

- Job Insecurity: Uncertainty about employment can make long-term financial planning feel daunting and impossible, as the fear of sudden job loss looms large. The anxiety associated with job instability can affect not only your financial situation but also your mental health and relationship dynamics.

- Economic Conditions: External factors such as a recession or inflation can amplify financial worries, making it feel as though the odds are stacked against you, with external forces beyond your control. These conditions can create a pervasive sense of anxiety that permeates everyday life, affecting your decision-making abilities.

- Medical Expenses: Unforeseen medical costs can destabilize even the most carefully planned budgets, leading to feelings of helplessness and the fear of falling into debt. The burden of medical debt can be particularly stressful, as it combines both financial and emotional challenges.

Once you pinpoint the exact reason behind your financial stress, you can take appropriate steps to address it How to Manage Financial Anxiety. Recognizing the cause is an essential step in learning how to manage financial anxiety effectively. It not only clarifies the problem but also opens the door to potential solutions and coping strategies that align with your unique circumstances.

Real-Life Example:

Consider Sarah, a marketing professional who constantly worries about her credit card debt. After some reflection, she realizes that her anxiety stems from high-interest loans and impulsive spending habits How to Manage Financial Anxiety. By identifying her spending patterns and acknowledging her emotional connection to money, she can start taking actionable steps toward regaining financial control. This newfound awareness allows her to approach her finances with clarity and purpose, transforming anxiety into a proactive mindset that motivates her to create a healthier financial future.

Expert Advice:

According to financial therapist Amanda Clayman, “Understanding the emotional connection to money can help individuals recognize and resolve financial anxiety. Acknowledging fears and creating an action plan can lead to long-term relief.” This understanding can be transformative, guiding you toward a more constructive relationship with money. Establishing a clear action plan not only gives you direction but also empowers you to confront your fears head-on, creating a pathway toward financial stability.

2. Create a Realistic Budget and Stick to It

A well-structured budget is a powerful tool in managing financial anxiety. Budgeting allows you to track your income, expenses, and savings, helping you stay in control of your finances and alleviating stress. A budget can serve as a roadmap, guiding you through your financial landscape with confidence and clarity.

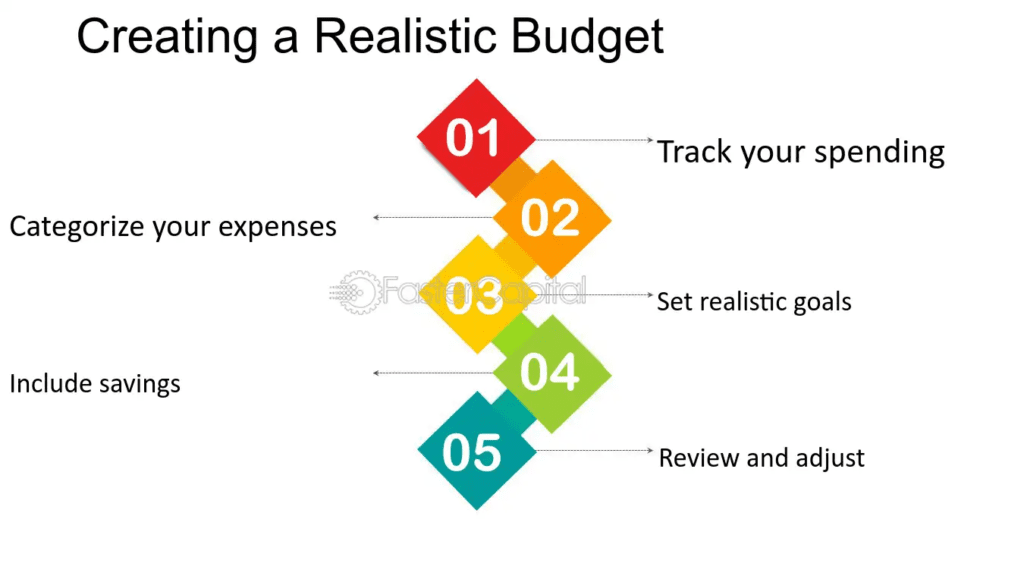

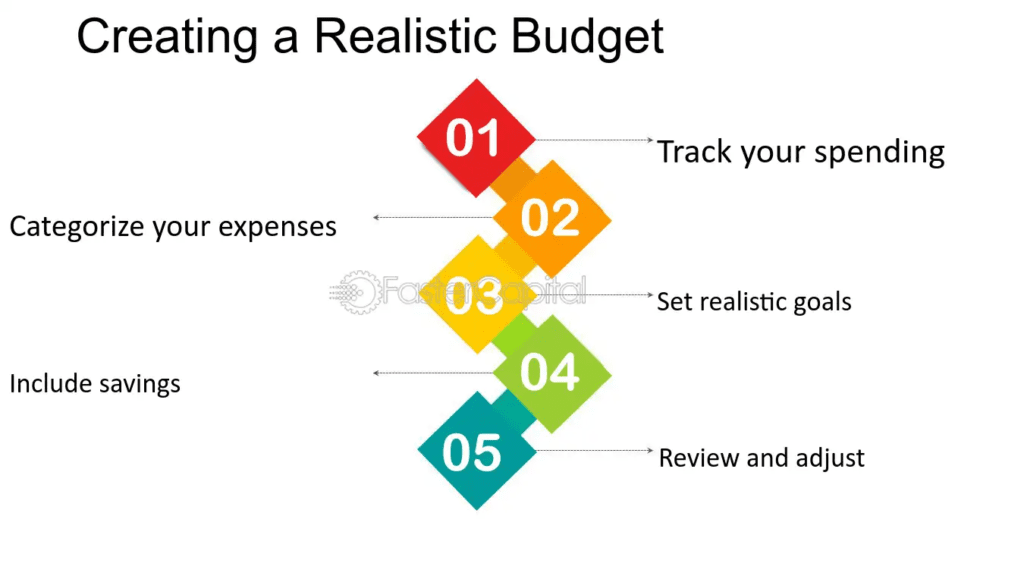

Steps to Create a Budget:

- List Your Income: Start by compiling all sources of income, including your salary, side hustles, and any passive income streams. Knowing exactly how much money you have coming in can provide a sense of stability and security, allowing you to make informed financial decisions.

- Track Your Expenses: Categorize your spending into essentials (such as rent, groceries, and utilities) and non-essentials (like entertainment and dining out). This process can illuminate spending habits and highlight areas where adjustments can be made. By understanding where your money goes, you can identify patterns that may contribute to anxiety.

- Set Financial Goals: Define your short-term and long-term financial goals, allocating a portion of your income toward savings and investments. Clear goals can give your budgeting efforts purpose and direction, motivating you to stay committed to your financial plan.

- Cut Unnecessary Expenses: Take a hard look at your spending habits and identify areas where you can reduce non-essential expenses, freeing up money for your priorities. Making small sacrifices now can lead to peace of mind later, as you create a buffer against unexpected financial challenges.

- Monitor and Adjust: Regularly review your budget to make necessary adjustments based on changes in income or expenses. Life is unpredictable, and your budget should be flexible enough to adapt to new circumstances. This adaptability can foster resilience and reduce anxiety as you navigate life’s uncertainties.

By maintaining a realistic budget, you can ensure financial stability and significantly reduce stress related to money matters How to Manage Financial Anxiety. A budget isn’t just a set of numbers; it represents your values, priorities, and aspirations. It is a living document that evolves with you, reflecting your changing needs and goals.

Case Study:

David, a college student, struggled with financial anxiety due to poor money management. After creating a simple budgeting plan, he made conscious efforts to reduce unnecessary spending on fast food and entertainment How to Manage Financial Anxiety. Within six months, he noticed a marked decrease in his stress levels, as he was able to cover his essential expenses and even put money aside for savings. This experience empowered him, transforming his relationship with money from one of anxiety to one of control and clarity. He learned that budgeting could be a source of empowerment rather than a restriction, allowing him to plan for a future he could look forward to.

Additional Tip:

Utilize budgeting apps like Mint, YNAB (You Need a Budget), or PocketGuard to automate tracking and improve your financial planning. These tools can simplify your budgeting process and provide insights into your spending habits, making it easier to stay on track. The convenience of technology can turn budgeting into a more manageable task, allowing you to focus on the bigger picture rather than getting bogged down by details.

3. Build an Emergency Fund

One of the most effective strategies for managing financial anxiety is establishing an emergency fund. Financial emergencies—such as unexpected medical bills, car repairs, or sudden job loss—can create significant stress How to Manage Financial Anxiety. An emergency fund serves as a safety net, helping to alleviate worries about unforeseen expenses and providing peace of mind that you can handle whatever life throws your way.

How to Build an Emergency Fund:

- Start Small: Begin by saving a small amount each month, even if it’s just $20. Every little bit counts and can add up over time, paving the way for a more secure financial future. Starting small can make the process feel less daunting and more achievable.

- Automate Savings: Set up automatic transfers to your savings account, so you consistently contribute to your emergency fund without needing to think about it. Automating savings can remove the temptation to spend that money elsewhere, allowing you to build your fund without added stress.

- Cut Unnecessary Costs: Redirect money from luxury expenses or discretionary spending to bolster your emergency fund. This conscious choice can help prioritize financial security over fleeting pleasures, instilling a sense of discipline that can positively impact your overall financial health.

- Set a Goal: Aim to save at least 3-6 months’ worth of living expenses to provide a solid cushion against unexpected financial burdens. Knowing your target can motivate you to save diligently and take the necessary steps toward achieving it.

- Explore High-Yield Savings Accounts: Consider opening a high-yield savings account to earn interest while keeping your emergency fund easily accessible. This not only helps your money grow but also makes it work harder for you, allowing you to achieve your savings goal more efficiently.

Success Story:

Maria, a single mother, started saving small amounts each month despite her tight budget. Over two years, she built an emergency fund that enabled her to manage an unexpected medical expense without the usual stress and turmoil How to Manage Financial Anxiety. This fund became her safety net, allowing her to navigate challenges with greater confidence and resilience. The peace of mind that came from having savings in place transformed her approach to spending and saving, empowering her to make choices that aligned with her long-term goals.

Additional Tip:

To accelerate your savings, try the 52-week savings challenge—start by saving $1 in the first week and increase it by $1 each week. By the end of the year How to Manage Financial Anxiety, you will have saved $1,378, providing a substantial boost to your emergency fund! This challenge can not only enhance your savings but also instill a sense of accomplishment as you witness your progress each week, reinforcing positive financial behaviors.

4. Manage Debt Effectively

Debt is a significant contributor to financial stress, and learning how to manage financial anxiety means addressing debt strategically How to Manage Financial Anxiety. Unmanaged debt can feel overwhelming, but with the right approach, you can regain control over your financial situation and pave the way toward a debt-free future.

Strategies to Manage Debt:

- Prioritize High-Interest Debt: Focus on paying off high-interest loans first to minimize financial burden and save money in interest payments over time. How to Manage Financial Anxiety Tackling the highest rates can provide immediate relief and motivate you to continue making progress toward financial freedom.

- Consider Debt Consolidation: Look into consolidating multiple debts into one lower-interest loan, simplifying your payments and potentially reducing your monthly payment amount. This can make your debt more manageable and less daunting, allowing you to focus on building a brighter financial future.

- Negotiate with Lenders: Don’t hesitate to reach out to lenders to request lower interest rates or better payment terms; they may be willing to work with you to avoid default.How to Manage Financial Anxiety Open communication can often lead to favorable outcomes, allowing you to regain control over your financial obligations.

- Make More than Minimum Payments: Paying only the minimum keeps you in debt longer and can lead to increased interest costs. Aim to pay more whenever possible to reduce the principal balance quicker, allowing you to escape the debt cycle sooner and experience the relief that comes with being debt-free.

- Avoid Accumulating More Debt: Resist the temptation of impulse purchases and unnecessary borrowing,How to Manage Financial Anxiety which can compound your debt situation. Establishing a mindful approach to spending can be transformative, empowering you to make better financial decisions and prioritize your long-term goals.

Example:

John had five credit cards with outstanding balances. He utilized the debt snowball method, paying off the smallest balance first while making minimum payments on the rest How to Manage Financial Anxiety How to Manage Financial Anxiety. Over time, he eliminated all his debt and was able to enjoy a newfound sense of financial peace. This process not only improved his financial situation but also fostered a sense of accomplishment and empowerment, reinforcing positive financial habits that would serve him in the long run.

Additional Tip:

Explore balance transfer credit cards that offer a 0% interest period, allowing you to pay off your balance faster and save on interest costs How to Manage Financial Anxiety. This can be a strategic move to gain momentum in your debt repayment journey, providing you with the opportunity to make faster progress toward your financial goals.

5. Increase Your Income

Another effective way to manage financial anxiety is to boost your income. Earning more money can help you cover expenses How to Manage Financial Anxiety, save more, and reduce financial stress significantly. A higher income can provide the breathing room needed to navigate life’s unpredictability and build a more secure financial future.

Ways to Increase Your Income:

- Ask for a Raise: If you’ve been performing well at work and contributing positively to your organization, don’t hesitate to negotiate for a higher salary. Demonstrating your value can reinforce your worth and lead to financial rewards, allowing you to feel more secure in your financial situation.

- Start a Side Hustle: Consider freelancing, tutoring, or starting a small business that aligns with your skills and interests. This can not only supplement your income but also provide a creative outlet, allowing you to explore passions and talents while building a financial safety net.

- Invest Wisely: Explore options like stocks, real estate, or mutual funds that can generate passive income over time, contributing to your financial security. Researching investment opportunities can empower you to make informed decisions that will benefit you in the long run.

- Enhance Your Skills: Invest in your education by taking online courses or attending workshops to increase your value in the job market and boost your earning potential. Continuous learning can open new doors for career advancement and allow you to take on more lucrative roles.

- Sell Unused Items: Declutter your home and sell items you no longer need. This not only provides extra cash but also frees up space in your living environment, creating a sense of order and clarity that can enhance your overall well-being.

Additional Tip:

Consider creating digital products, such as e-books or online courses, that generate passive income over time How to Manage Financial Anxiety, allowing you to earn money while you sleep! This approach can lead to a sustainable income stream that complements your primary financial efforts, ultimately providing greater financial freedom and security.

6. Develop a Positive Money Mindset

Your mindset plays a crucial role in managing financial anxiety. A negative perception of money can heighten stress levels How to Manage Financial Anxiety, while a positive outlook fosters financial confidence and resilience. Cultivating a healthy money mindset can transform your relationship with finances and empower you to make better decisions.

Tips to Improve Your Money Mindset:

- Practice Gratitude: Shift your focus from what you lack to what you have. Regularly remind yourself of the financial resources and opportunities available to you How to Manage Financial Anxiety, fostering a sense of abundance rather than scarcity. This shift in perspective can greatly reduce anxiety and help you appreciate what you have.

- Avoid Comparison: Don’t compare your financial situation with others. Everyone’s journey is unique, and comparison can lead to feelings of inadequacy. Instead,How to Manage Financial Anxiety celebrate your progress and focus on your path, understanding that your financial journey is yours alone.

- Educate Yourself: Read books, attend workshops, or consume content on personal finance to improve your knowledge and skills.How to Manage Financial Anxiety Knowledge is power, and understanding financial concepts can help alleviate anxiety, equipping you with the tools to make sound financial decisions.

- Set Achievable Goals: Break down your financial goals into smaller, manageable steps. Achieving small financial wins can build your confidence and motivate you to continue striving for larger goals, How to Manage Financial Anxiety reinforcing positive behaviors and habits.

- Celebrate Progress: Acknowledge and celebrate your improvements in money management, no matter how small. This positive reinforcement can motivate you to continue making progress and reinforce healthy financial habits that contribute to your overall well-being.

Additional Tip:

Consider keeping a journal where you write down positive affirmations about money daily, such as “I am in control of my finances” or “I attract financial abundance.” This practice can significantly shift your mindset over time, helping to counteract negative thoughts and instill a sense of empowerment that will serve you well in your financial journey.

Conclusion

Learning how to manage financial anxiety can empower you to take control of not only your money but also your mental well-being. By implementing these seven actionable steps, you can embark on a journey toward financial confidence and peace of mind How to Manage Financial Anxiety. As you navigate the complexities of personal finance, remember that it’s not just about numbers; it’s about creating a life that aligns with your values and aspirations.

What personal tips do you have for managing financial anxiety? Share your thoughts and experiences in the comments below! Your insights could help others on their journey to financial well-being and foster a supportive community focused on empowerment and growth How to Manage Financial Anxiety. Together, we can break the cycle of financial anxiety and create a brighter, more secure future for ourselves and those around us. By sharing our experiences and strategies, we can not only help ourselves but also uplift others who may be struggling with similar challenges, fostering a sense of community and shared purpose.